By Ralph Maurer, professor of practice and executive director of the Tulane Family Business Center

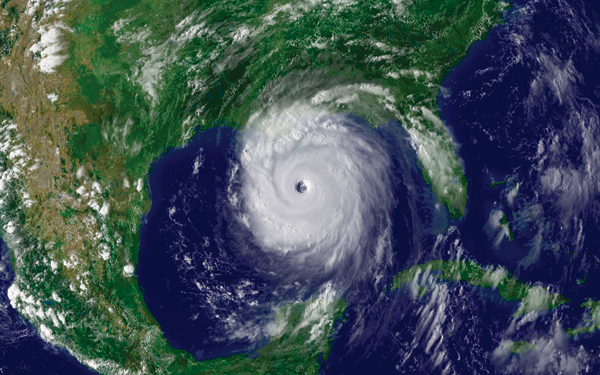

As executive director of the Tulane Family Business Center, one of my primary research interests is family business, and in the last several years, I’ve spent a significant amount of time thinking about how medium and large family-owned firms on the Gulf Coast responded to Hurricane Katrina in comparison to their publicly held or private non-family held peers. Working with family-owned firms in New Orleans over the past few years, I started hearing stories about the days, months and years after Katrina and how these firms maintained continuity and restructured in response to the disaster. These stories differed significantly from those I heard from non-family firms, and they led me to conduct a formal academic study comparing the two groups. To my surprise, I found that existing academic research on exogenous shocks—large external events that disrupt business—had very little say on this topic, particularly with regard to long-term business recovery, and thus presented an ideal research opportunity.

While my research is still in its early stages, I’ve observed two strong trends in the data, both of which stem from the unique qualities of family-owned firms. The first is that family-owned firms are historically very closely tied to a particular city or region, making it difficult for those organizations to relocate assets. Secondly, they are very closely tied to their employees, both family and non-family. These unique connections can bring benefits in normal circumstances, such as fostering strong customer relationships and employee loyalty, but they can also constrain the ability of family-owned firms to respond nimbly to a disaster. For example, because of their long histories in a region and emotional ties to their employees, owners of family firms tend to find it especially difficult to move their headquarters and relocate personnel. Public companies, on the other hand, are adept at relocating plants and people when situations require it.

So how do family businesses survive disasters like Katrina in the long term? I think the key is to engage in a creative act called bricolage, a concept borrowed from the literature on innovation. Bricolage entails the creative recombination of resources and business units and uses bricolage art—a mixed-media piece similar to a collage—as a metaphor. Essentially, a firm must work with the constraints and resources it has but creatively manipulate the architecture of the organization. This means maintaining strong ties to the region and existing employees while simultaneously shifting the customer, product and/or fixed asset mix or the way business units connect with each other. For example, an industrial chemicals company I’ve worked with retrained its very capable inside sales personnel to handle outside sales in more remote locations after local industrial demand stagnated in the wake of Katrina. This creative use of resources, one that leveraged existing strengths in a new, previously untried way, is I think an essential step to surviving a disaster.

This creative recombination can also have benefits beyond mere survival. Events like Katrina, as horrible as they are, can actually be an opportunity for family businesses to emerge stronger. Sometimes they need a jolt to the system to make all the wonderful resources and relationships they have work more efficiently, and based on what I’ve observed in my work with the Family Business Center, the most successful family-firms on the Gulf Coast were able to do just that.

Ralph Maurer is a professor of practice and executive director of the Tulane Family Business Center, which was established in 1992 to assist family-owned enterprises with the unique issues and challenges they face in growing and prospering from one generation to the next. Operated under the auspices of the Freeman School’s Levy-Rosenblum Institute, the Tulane Family Business Center sponsors seminars, lectures and programs featuring nationally recognized experts on family business issues as well as providing consulting services and networking opportunities for family business members.